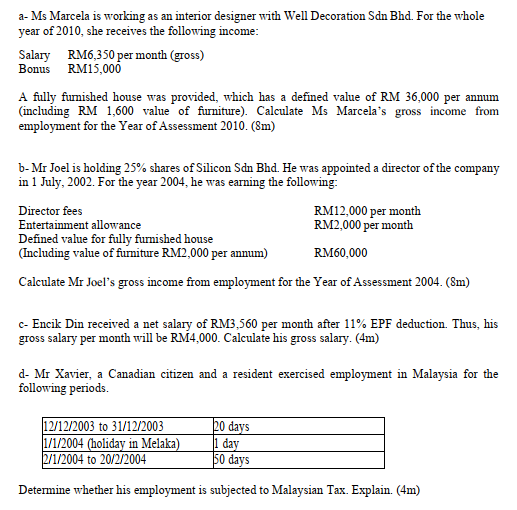

income tax malaysia 2018 calculator

However every section amongst these has a pre-set maximum investment amount. If a Malaysian or foreign national knowledge worker resides in the Iskandar Development Region and is employed in certain qualifying activities by a designated company and if their employment commences on or after 24 October 2009 but not later than 31 December.

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

HR Block employees including Tax Professionals are excluded from participating.

. We ask the month as well as the year of your birth to get a. Must contain at least 4 different symbols. Estimated pre-tax income.

2018 Jeep Grand Cherokee. The loan is secured on the borrowers property through a process. Available at participating offices and if your employers participate in the W-2 Early Access program.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Central Goods and Services Act 2017. 6 to 30 characters long.

Italy Jamaica Japan Kazakhstan Kenya Kosovo Laos Latvia Liberia Liechtenstein Lithuania Luxembourg Macedonia Madagascar Malawi Malaysia Maldives Malta Mauritius Middle East Region Middle East Bahrain Egypt Iraq Jordan Kuwait. Rs 50 The law has fixed a maximum late fees of Rs 10000 up to May 2021. One can do the income tax computation manually or using an income tax calculator.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom. 667 per month if starting at age 65.

Our suites of tax calculators are built around specific country tax laws and updated annually to provide a dependable tax calculator for your comparison of salaries when looking at new jobs reviewing annual pay. Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. Referred client must have taxes prepared by 4102018.

Provisional Tax Generator EPT PAYE Calculators 2017 2011. HR Block employees including Tax Professionals are excluded from participating. I have updated the income tax calculator for Thailand I hope it helps your users.

For PAYE final you can request for a review of the tax assessed. International tax law distinguishes between an estate tax and an inheritance tax citation needed an estate tax is assessed on the assets of the deceased while an inheritance tax is. The system is thus based on the taxpayers ability to pay.

I have closed my tax file in Malaysia when I relocated to Thailand. Non-residents are subject to withholding taxes on certain types of income. The income tax rate applicable for an individual depends on the tax slab under which they fall.

2015 Chevrolet Silverado 2500HD. Available at participating offices and if your employers participate in the W-2 Early Access program. I will be returning to Thailand from ireland In 2018 I spent 4 months in ireland 2019 7 months 2020 7 months and it looks.

ASCII characters only characters found on a standard US keyboard. This maximum investment amount is decided by the government. Residents Tax Rates 2001 2019.

Can I request for an amendment to my income tax return. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. Latest news expert advice and information on money.

Referred client must have taxes prepared by 4102018. Other income is taxed at a rate of 30. As per the Income Tax Act whatever professional tax an individual has paid during the last year is.

Malaysians cannot continue to be burdened with this tax on top of tax and Budget 2023 is the best opportunity for the prime minister to make the people happy. Available at participating offices and if your employers participate in the W-2 Early Access program. 30 Dec 2018.

For example for a salaried individual the income from salary includes. HR Block employees including Tax Professionals are excluded from participating. My support is about THB.

8 EPF contribution removed. PAYE SRT. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Exempt until 31st march 2018Capital gains more than Rs1 Lakh are taxable at 10 15. Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. Employment Insurance Scheme EIS deduction added.

Name of the Act Late fees for every day of delay. Any State Government is not eligible to impose more than Rs2 500 annually as professional tax. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation.

An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate money and property of a person who has died. All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Estimate your personal income taxes in each province and territory with our Income Tax Calculator for Individuals. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D.

Free Online Salary and Tax Calculators designed specifically to provide Income Tax and Salary deductions for Individuals families and businesses. For a more accurate result take a look at the Canadian Retirement Income Calculator. There is no ceiling in monetary terms in the Income Tax Act in article 276 of the Constitution.

Rs 25 Respective State Goods and Services Act 2017 or Union territory Goods and Services Act 2017. Rs 25 Total late fees to be paid per day. EPF tax relief limit revised to RM4000 per year.

EIS is not included in tax relief. Based on the income tax slab an individual falls into they do their maximum tax saving. Removed YA2017 tax comparison.

Pensions property and more. Referred client must have taxes prepared by 4102018. Updated PCB calculator for YA2019.

Other helpful calculators to try. Thanks for the update on the tax rates.

Income Tax Malaysia 2018 Mypf My

Professional Tax Preparation Services Near Ardmore Ok

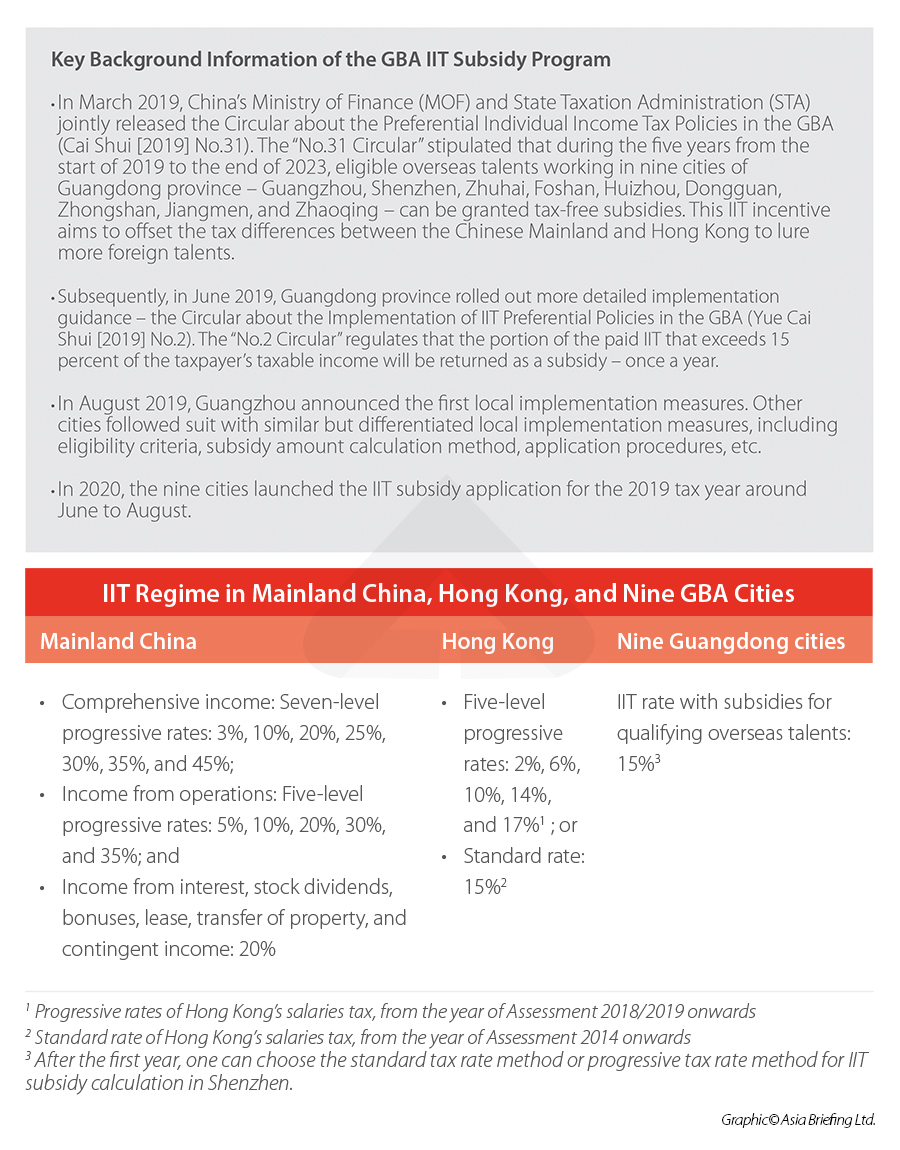

The Revolution In China Individual Income Tax Law As Of 2019 Rodl Partner

Residential Status Calculator Should An Nri File Taxes In India

Percentage Columns For The Income Statement Are Here Xero Blog

How To Calculate Income Tax In Excel

6 35 Crore Itrs Electronically Filed Till Mid February 2020 Up From 6 28 Crore In 2018 19

Iit Subsidies In China S Greater Bay Area File Your 2021 Application Now

Provision For Income Tax Definition Formula Calculation Examples

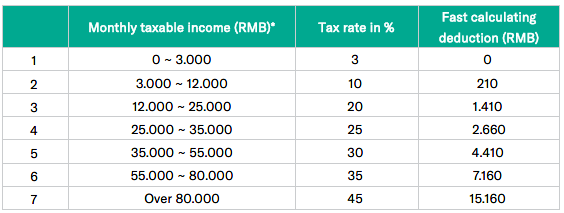

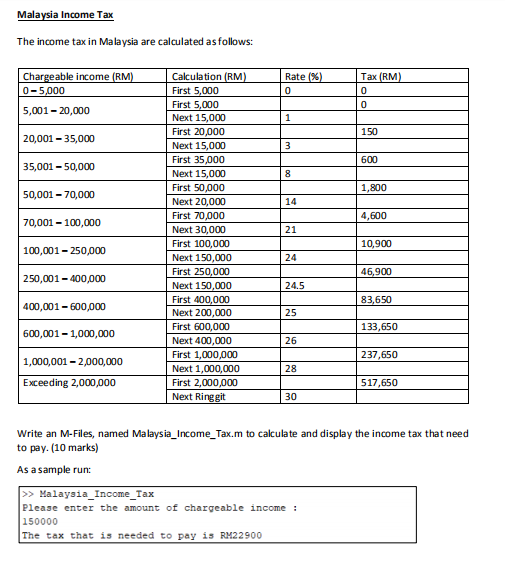

Solved Malaysia Income Tax The Income Tax In Malaysia Are Chegg Com

Irs Installment Agreement Tax Payment Options

Malaysian Taxation Question 1 Use Tax Relief 2018 Chegg Com

Japan Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Income Tax Malaysia 2018 Mypf My

How To Calculate Inventory Turnover Examples

When Can Borrowing Save You Taxes Securities Backed Line Of Credit Explained Wealth Legacy Group Inc

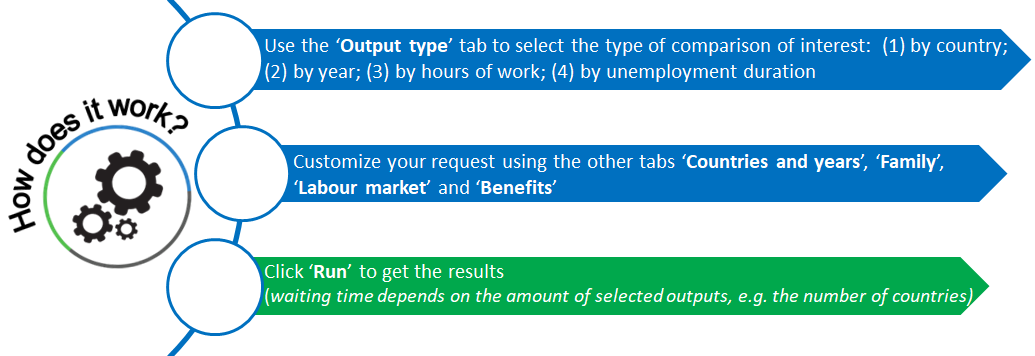

Tax Benefit Web Calculator Oecd

How To Calculate Foreigner S Income Tax In China China Admissions

Comments

Post a Comment